Lifecycle Services

Monitor structured products lifecycle events and obtain automated alerts and advice so you can deliver premium support to your clients

Lifecycle Services is a powerful monitoring tool that complements the Structure Product RFQ service – offering users compelling insights into the process from issuance to maturity and enabling them to easily notify structured product investors about upcoming events – from coupon payments to autocalls or barrier hits

This service helps you to significantly increase secondary market turnover by identifying products in need of restructuring ahead of barrier or early termination events.

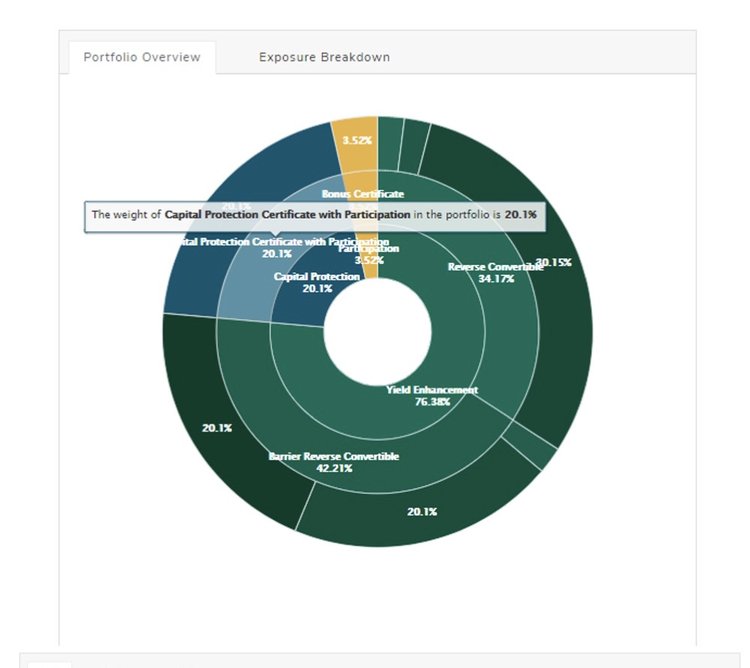

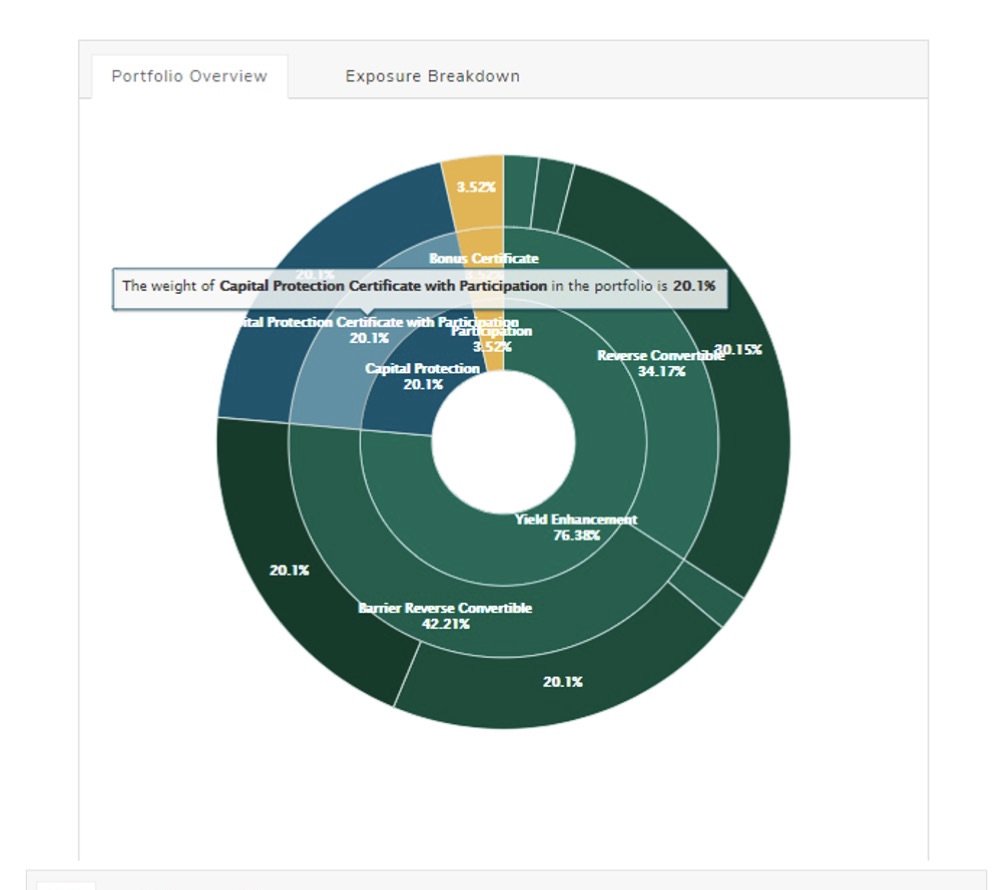

An interactive and modular dashboard with unique graphic representations of data based on advanced analytics helps you visualize each structured product’s past, present and future.

In addition, state-of-the-art quantitative tools such as regime detection and timeseries analysis provide you with a useful estimate of the probability of barrier and autocall events occurring – so you can take the right action at the right time to optimally support your clients.

Key features

Seamless integration with RFQ

Instantly monitor products issued via the Structure Product RFQ service

Restructuring advice

Obtain automated secondary market advice if a product needs restructuring

Coupon, autocall and barrier monitoring

Keep track of upcoming coupon payments, early termination events and barrier events – including probability – and obtain early warnings when the tide turns and an underlying is at risk of hitting the barrier

Alerts and action items

Receive product-level alerts and notifications so you always have the latest information at your fingertips

Automated notifications

Personalize e-mail notifications to help proactively manage individual client needs and expectations

Corporate actions

Stay informed about corporate events such as stock-splits, mergers and acquisitions or spin-offs as they happen thanks to automatic detection and updates

Scenario and risk analysis

Estimate P&L changes with greater accuracy based on effective risk scenario analysis

Price projections

Get an idea of where underlyings are heading based on regime detection and fundamental analysis – allowing you to plan ahead before a barrier event actually happens