Investment Matcher

Leverage state-of-the-art tools and analytics to deliver personalized investment solutions ideally matched to client needs

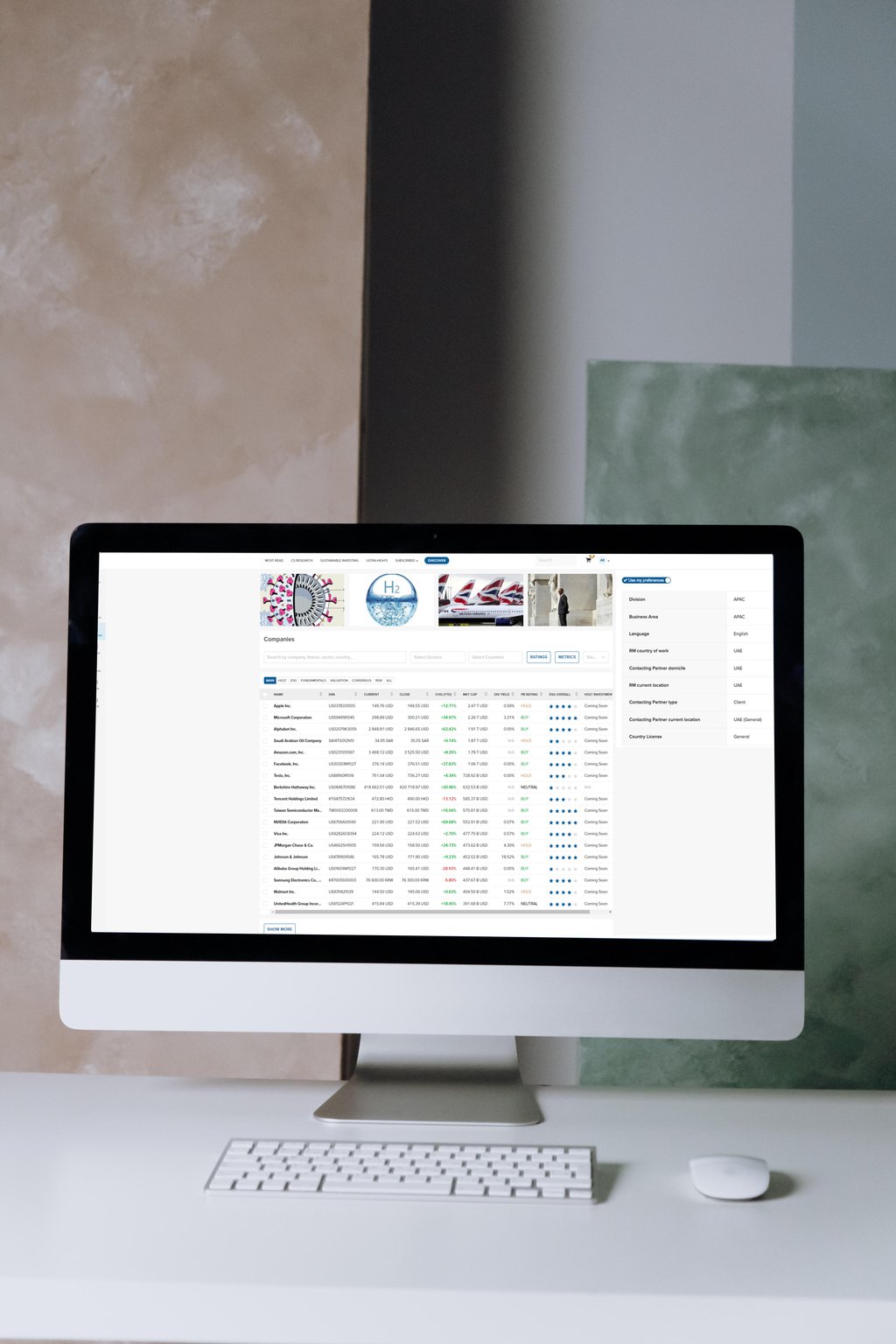

The Investment Matcher platform plays a central role in the delivery of personalized investment solutions

It systematically searches a range of asset classes – from equities and fixed income to funds and structured products – and retrieves the products most closely aligned with the investor’s profile and needs, all with the support of powerful filtering and analytics tools.

Investment Matcher allows for the consistent combination of reference criteria (e.g. sector or geography), fundamental criteria (e.g. income statement or valuations), service provider criteria (e.g. ESG or rating) and, importantly, wealth manager CIO criteria (e.g. master lists or regional focus lists).

Investment Matcher incorporates a full applicability and suitability value chain with rules authoring, deployment, repository and the execution value chain.

Designed to ensure an enhanced user experience, Investment Manager offers easy navigation across asset classes. And its link to Wealth Pitch allows users to integrate matched investment solutions with CIO wealth intelligence for optimal client outcomes.

Investment Matcher can be integrated as a service to existing core banking and CRM platforms via a rich set of APIs.

Key features

Natural Language Processing (NLP)

Powerful solution enabling products to be retrieved from our vast proprietary ontology based on the application of natural language concepts

Effective filtering

Leverage advanced data models combining reference data, fundamental data, internal CIO process data and external sources to identify the most appropriate investment solutions

Notification services

Possibility to define and apply advanced search and filtering criteria and obtain notifications whenever new solutions are available

Business Rules Management Systems (BRMS)

Combine investor profiles, interaction scenarios and product data to assess the applicability and suitability of offerings

Advanced analytics

Ability to collect and analyze content consumption events and cross-check with business activity events

Content Management System

Tool to create and publish investment recommendations in multiple formats