Where personalization meets contextualization - for superior high-net-worth private banking solutions

Wealth management and private banking are one of the most attractive sectors in financial services in terms of growth and profitability. Significant potential lies in the use of technology to hyper-personalize wealth management advice and investment themes to perfectly match client needs and expectations. There is also significant scope to enhance overall productivity and efficiency thanks to scalable digital solutions for the high-net-worth (HNW) client segment.

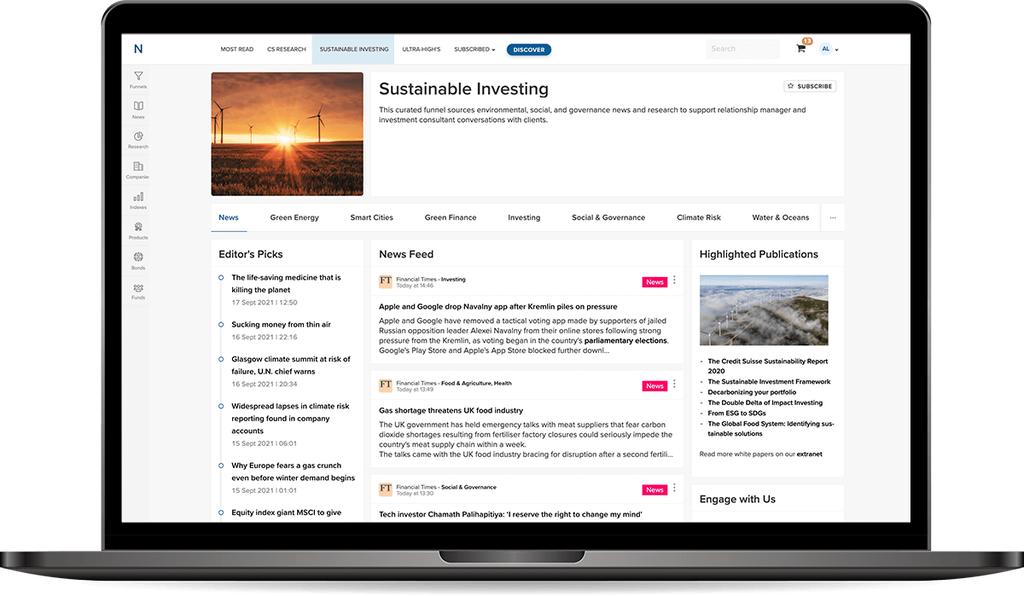

Move Digital has unrivalled technology that empowers relationship managers and investment consultants to efficiently offer bespoke private banking advice to their clients. In the context of open banking in particular, our technology enables wealth managers to deliver personalized recommendations to clients at scale, bringing together best-in-class products.

Move Digital offers innovative technology and a unique approach that enables wealth managers to digitalize their value chain and create new value propositions and opportunities for their business.

Move Digital's solutions:

- Are validated and used by global leaders of wealth management - with more than 5,000 users worldwide

- Provide a live ecosystem integrated with content, news, data, research and investment products from industry-leading providers

- Offer hedge fund-like investment and risk management capabilities as a service for wealth managers

- Take personalization and contextualized reporting to a new level for powerful private banking solutions